Important notification on data privacy and cookie notice

We use cookies to ensure you get the best experience on https://www.sunlifegrepa.com. By continuing to browse our site, you are agreeing to our use of cookies.-

PHILIPPINES | EN

- Home

- Insurance

- Back

- Insurance Overview

- Income Continuation

- Education

- Retirement & Estate Preservation

- Preparing for Life’s Milestones

- Health Protection

- Supplementary Benefits

- Group Healthcare

- Loan Protection Program

- Employee Financial Program

- Bancassurance Solutions

- Tools & Services

- Fund Options

- Back

- Fund Options Overview

- NAVPU

- SLG Balanced Fund

- SLG Bond Fund

- SLG Captains Fund

- SLG Dynamic Fund

- SLG Equity Fund

- SLG Global Growth Fund

- SLG Global Income Fund

- SLG Global Opportunity Fund

- SLG Global Opportunity Payout Fund

- SLG Growth Fund

- SLG Growth Plus Fund

- SLG Income Fund

- SLG Index Fund

- SLG MyFuture Fund

- SLG Money Market Fund

- SLG Opportunity Fund

- SLG Opportunity Tracker Fund

- SLG Peso Global Growth Fund

- SLG Peso Global Income Fund

- SLG Peso Global Opportunity Payout Fund

- SLG Peso Global Opportunity Fund

- SLG Peso Global Sustainability Growth Fund

- SLG Peso Global Tech Payout Fund

- SLG Peso Global Tech Growth Fund

- SLG Global Tech Payout Fund

- SLG Global Tech Growth Fund

- Life Goals

- Back

- Life Goals Overview

- Grow Your Money

- Take Care of Your Family

- Nurture Your Health

- Enjoy Retirement

- Money For Life

- About Us

- Back

- About Us Overview

- Who we are

- Our Business Units

- Newsroom

- Corporate Governance

- Corporate Social Responsibility

- Careers

- Find a Form

- FAQs

- Contact Us

- How to file a claim

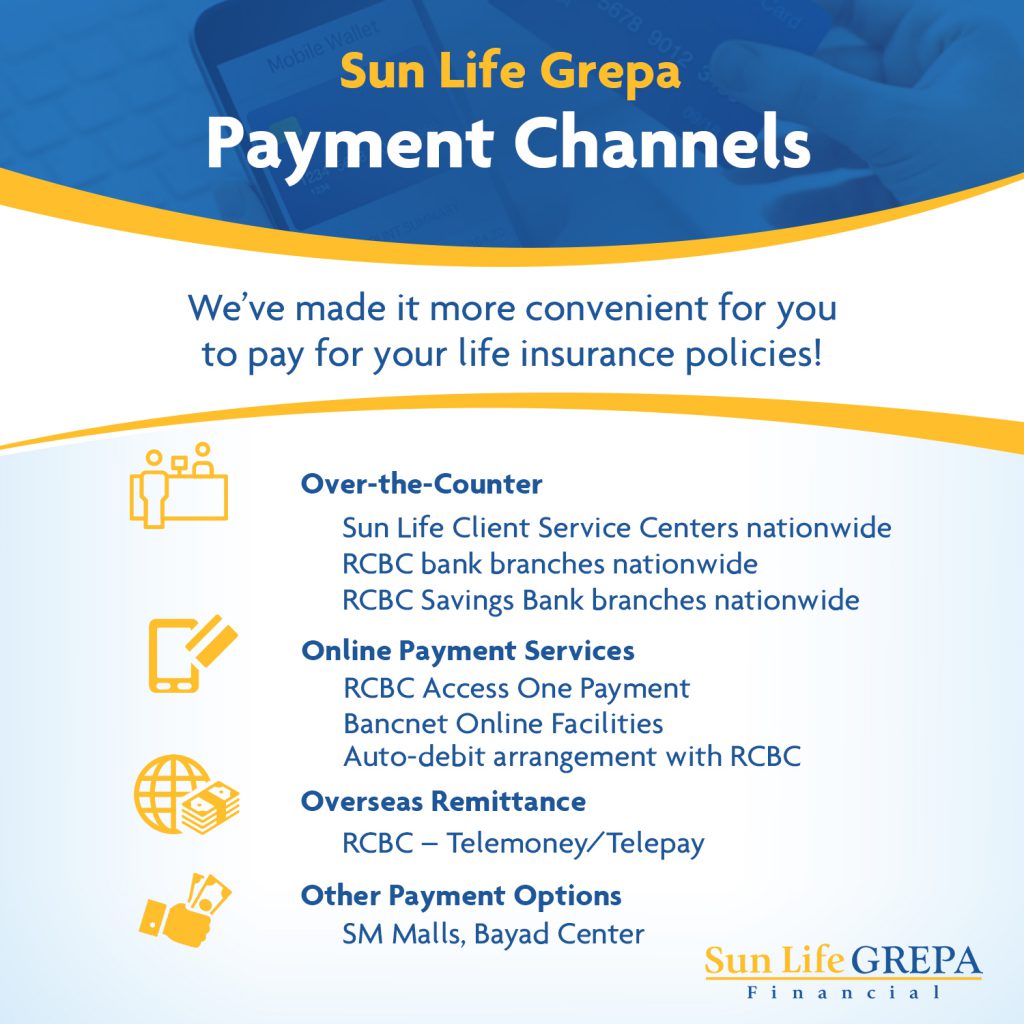

- Payment Channels

- Healthcare Providers

- Sustainability

- Advisor List

Sun Life Grepa Financial, Inc. (Sun Life Grepa) and RCBC launch the Fast Break program, an innovative process that enables select bank clients to avail of life and health insurance plans under a much simplified application process.

Fast Break uses data analytics to determine the client’s risk profile. Through this process, clients are given the most suitable and optimized products to help them realize their financial objectives and protection goals. Moreover, those who pre-qualify for the Fast Break program will enjoy higher coverage limits, waived medical examination and random testing, and waived financial underwriting. They may even use their RCBC Bankard credit card to pay for their insurance premiums.

“Through the Fast Break program, we can better recommend solutions that are tailor-fit to our clients’ needs while simplifying our insurance application process,” says Sun Life Grepa Financial President, Richard S. Lim. “With our current situation, our goal is to make business with us as easy and as convenient as possible. We acknowledge the fact that people’s way of life is fast changing especially under the ‘new normal’ and that we need to provide service that is meaningful, effective and efficient.”

The Fast Break program is available for a limited period only to pre-qualified RCBC clients. For more information, bank clients may inquire with their RCBC branch of account or call Sun Life Grepa at (02) 88499633

Sun Life Grepa Financial, Inc. (Sun Life Grepa), one of the Philippines’ top life insurance companies, opens 2020 with a most promising outlook as it continues its 2019 streak of successes, foremost of which is helping protect 2.9 million Filipino lives.

With this achievement, Sun Life Grepa exceeded its five-year target of 2.5 million lives, which it set out to achieve by 2020. On top of this, Sun Life Grepa also marked a 48% increase in net income, and 22% increase in its agency force.

“All these achievements were driven by our commitment to the Filipino people. We were especially inspired in 2019, as we celebrated our companyÆs 65th anniversary,ö says Richard Lim, Sun Life Grepa President. ôThis 2020, we have the momentum to aim for more, as we strive to provide our clients with new ways of growing and protecting their goals with us. It is always by listening to their needs that we are able to continue providing such levels of service.”

Meanwhile, other initiatives launched were the Sun Grepa PH app, as well as its online client portal, My Sun Life Grepa. Both channels will afford Sun Life Grepa’s clients more convenience in managing their policies.

The company also launched several products, namely: Sun Grepa Senior Care, a health protection plan that provides coverage to those in their pre-retiree and retiree stages; Sun Grepa Power Builder 100, a Variable Universal Life (VUL) Insurance plan that offers a combined benefit of insurance protection and investment with coverage until age 100; and Sun Grepa Peso Asset Builder, a limited-offer VUL Insurance plan that provides easy access to global investment opportunities. Along with these, two new VUL fund options were also added: SLG Global Growth Fund is available through Sun Grepa Power Builder Dollar 1, while SLG Money Market Fund is available through any of Sun Life GrepaÆs peso-denominated VUL Insurance plans for fund switching/transfer.

Sun Life Grepa revitalized several of its sales offices, with more scheduled to follow suit this year onwards.

“We look forward to reaching more Filipinos,” says Lim. “In the years to come, we will continue to meet our commitment to help Filipinos build and protect their dreams through life and health protection as we continue to become their partner beyond a lifetime.”

Sun Life Grepa Financial, Inc. (Sun Life Grepa) launches the Sun Grepa Power Builder 100, an affordable investment-linked life insurance product ideal for young professionals. With coverage of up to 100 years old coupled with its investment-linked feature, this makes it an ideal companion in one’s financial journey as he begins taking control of his finances.

As a Variable Life Insurance plan, Sun Grepa Power Builder 100 enables a client to grow his money over time through its investment fund options that cater to various risk appetites and financial objectives. Aside from providing security and investment opportunity, Sun Grepa Power Builder 100 allows one to customize his protection plan through the addition of optional coverage and benefits.

“Sun Grepa Power Builder 100 is very special for us because it paves the way for those who are starting up with their journey to financial freedom. Its affordability, coupled with the security it offers and the chance to grow one’s money makes it suitable for everyone who wants to commit to lifetime financial protection for themselves and their loved ones,” says Richard S. Lim, President of Sun Life Grepa.

To make things more convenient, clients can pay for their premiums through various methods like, auto-debit or auto-charge arrangements for RCBC bank account holders. This is in addition to paying at any of Sun Life Grepa’s payment centers. Clients can also opt to pay quarterly, semi-annually, or annually whichever suits them most.

“Protecting the financial future of every Filipino so that they can live healthier lives has been our mission statement,” says Sun Life Grepa President Richard S. Lim. “We are confident that our partnership with LifeData can help Filipinos build a bright future.”

Lim added that, “With Sun Grepa Power Builder 100, we hope to offer Filipinos with a product that helps them get started toward financial independence.”

Avail of Sun Grepa Power Builder 100 for as low as P51.63 per day (based on 25-year old male, non-smoker profile with 1M coverage)

To learn more about Sun Grepa Power Builder 100, ask a Sun Life Grepa financial advisor by calling (02) 8-849-9633. Clients may also visit any RCBC or Sun Life Grepa Financial branch or simply send an email to marketing@sunlifegrepa.com. Log on to www.sunlifegrepa.com

In a bid to continuously offer a meaningful service to its clients, Sun Life Grepa Financial, Inc. (Sun Life Grepa) has revitalized its Makati, Quezon City, Binondo, and Bulacan branches to reflect a modern, multi-functional, and ecological design.

The new design enhances collaboration and innovation with an agile mindset, while also sporting energy-saving capabilities within flowing, open space layouts. The facilities and infrastructure were also updated to work for multi-generational groups, making it suitable for Sun Life Grepa’s diverse community.

According to Richard S. Lim, President of Sun Life Grepa, the redesign symbolizes the company’s journey forward. “We are now more equipped to cater to the dynamism and ever changing needs of our clients, financial advisors, and employees,” he said.

Additional branches will be renovated this 2020, with more down the line in the years to come.

With over 65 years in the industry, Sun Life Grepa serves more than 2.9 million Filipinos in their pursuit of lifetime financial security and healthier lives. “With a steadily growing agency force and revitalized branches, we are gunning to expand our reach even further,” Lim said. “All these are a testament to our commitment of providing Filipinos with a brighter future.”

For more information on Sun Life, visit www.sunlifegrepa.com.

Sun Life Grepa Financial, Inc. (Sun Life Grepa) now offers more opportunities to gain easy access global equity investments through the new SLG Global Growth Fund.

SLG Global Growth Fund operates in a fund-of-funds structure that employs an active management investment strategy. The Fund invests primarily in foreign currency denominated high-quality equity and equity-linked securities or other vehicles invested in such securities, with the objective of generating long-term capital appreciation in US Dollars.

“Clients with an aggressive risk appetite who are willing to take on more risks in exchange for potentially higher returns are invited to diversify their spare US dollars through the SLG Global Growth Fund,” says Sun Life Grepa President Richard S. Lim. “We hope that through this fund, combined with the life insurance protection offered by Sun Grepa Power Builder Dollar 1, we can provide them opportunities to protect their dreams and help build lasting legacies for their loved ones.”

The SLG Global Growth Fund is one of the fund options exclusive to Sun Grepa Power Builder Dollar 1, an investment-linked life insurance product which provides guaranteed insurance coverage equal to at least 125% of the single premium until age 88. Furthermore, clients can enjoy hassle-free application and policy approval through the guaranteed insurability offer, subject to certain limits of the company.

Contact your Sun Life Grepa Financial Advisor, email wecare@sunlifegrepa.com or visit your nearest RCBC bank branch for details.

Sun Life Grepa Financial, Inc. (Sun Life Grepa), a major life insurance company in the country, partnered with the Philippine Business for Social Progress (PBSP) to launch the Zero Extreme Poverty Philippines (ZEPPH) 2030 campaign. Led by PBSP President Bro. Armin Luistro, the ZEPPH 2030 program is a collective movement of civil society organizations that are working together to alleviate poverty nationwide. Sun Life Grepa will support the life insurance needs of the program beneficiaries through special agreements with participating non-government organizations (NGOs).

“We are grateful for the chance to secure the dreams of Filipino families and be part of nation building,” says Sun Life Grepa President Richard S. Lim. “We believe that by enabling our countrymen to achieve financial security, we can help create a better, brighter Philippines.”

Sun Life Grepa’s purpose of providing lifetime security and healthier lives is aligned with the ZEPPH 2030 program’s objective of uplifting the lives of one million underprivileged families. Through the program, the targeted families will be given access to tools, knowledge and materials that will allow them to become self-sufficient by 2030. Specific focus areas towards achieving this goal have been identified by ZEPPH 2030, namely, Health, Education, Environment, Livelihood and Employment, Agriculture and Fisheries, Housing and Shelter, Peace and Human Security, and Social Justice. Public and private organizations will support a program area and coordinate their efforts with the PBSP according to the needs of the identified communities.

For more information, call Sun Life Grepa through its new number 88666337 starting October 6.

Sun Life Grepa clients can now manage their policies anywhere, anytime with the recently launched MySunLifeGrepa Client Portal along with its Sun Life Grepa PH mobile app.

Using the MySunLifeGrepa Client Portal or the Sun Life Grepa PH mobile app, clients can view their policies, update their contact information, or file a claim. For those on the go, the mobile app lets clients enjoy the same convenience through their mobile phones plus the ability to view their VUL fund values, locate the nearest Sun Life Grepa office, or contact a financial advisor.

“With greater digital access, our clients now have the opportunity to keep themselves updated on their life insurance policies through this handy online tool at their convenience,” says Richard S. Lim, President of Sun Life Grepa. “This way, they can make informed decisions about building their financial future with the guidance provided by Sun Life Grepa as their partner beyond a lifetime.”

Sun Life Grepa clients can sign up for the MySunLifeGrepa client portal at https://client.sunlifegrepa.com/portal/login. The Sun Life Grepa PH mobile app can be downloaded from the Google Play Store and Apple App Store.

Sun Life Grepa Financial, Inc. (Sun Life Grepa) is among the top insurance companies in the life insurance industry. For inquiries, contact wecare@sunlifegrepa.com, visit www.sunlifegrepa.com or call (+632) 8499633.

Click on the image to watch the video:

Sun Life Grepa Financial, Inc. (Sun Life Grepa), a major life insurance company in the Philippines, is celebrating its 65th anniversary on a high note as it marks several milestones in line with its mission of providing financial protection solutions to Filipinos.

To begin with, Sun Life Grepa has reached 2.5 million clients, significantly contributing to Sun Life Financial Philippines’ goal of serving 5 million clients by 2020. Meanwhile, the company also increased its total premium income by 21% from its individual and group business, while also growing its agency distribution channel by 33%.

All these resulted from Sun Life Grepa’s efforts to inspire Filipinos to aim for lifetime financial security as well as healthier lives. In fact, this was the rallying theme of the company’s brand campaign dubbed “Build Your Future: Dream It, Live It” which had Judy Ann Santos-Agoncillo as the brand champion.

“Guided by our vision to become the Filipino’s partner beyond a lifetime, our company shall continue to advocate lifetime financial security and healthier lives to Filipinos,” Richard S. Lim, President of Sun Life Grepa, expressed.

On top of its achievements, Sun Life Grepa remains steadfast with its corporate social responsibility efforts through its “Share the Passion” program, where employees are encouraged to volunteer by helping the homeless as well as participating in blood donation drives at the Arnold Jansen KALINGA Center and the children’s ward of the Philippine General Hospital respectively.

“We are happy to share these developments with our stakeholders,” Lim said. “We continue to find ways to help Filipinos achieve financial freedom and we remain driven by our mission to partner with Filipinos in building their dreams throughout and beyond their lifetime.”

As it welcomes another year, Sun Life Grepa aims to carry on its tradition of innovation through its affinity, agency, bancassurance, and group distribution channels.

Sun Life Grepa was established as the Great Pacific Life Assurance Corporation (Grepalife) in 1954 by the late Ambassador Alfonso T. Yuchencgo, an esteemed diplomat, philanthropist, business titan, and the founder of the Yuchengco Group of Companies.

With the intent to provide for the post-World War Two need to protect the financial future of Filipinos, the company pioneered industry innovations such as the installment payment scheme and the salary deduction plan making life insurance affordable for many Filipinos. Moreover, Grepalife also participated in the introduction of the Variable Universal Life (VUL) insurance on top of being the first insurance company to offer credit life insurance.

In 2011, the Yuchengco Group of Companies partnered with Sun Life Financial Philippines in a joint venture, giving birth to Sun Life Grepa Financial, Inc. (Sun Life Grepa).

Sun Life Grepa Financial, Inc. (Sun Life Grepa) continues to grow its presence in the country as it opens its relocated branch in Malolos, Bulacan along MacArthur Highway. This is in keeping with its mission to bring financial awareness to more Filipinos around the country and help protect their goals while living healthier lives.

The event was well-attended by branch personnel, some of whom received recognition for their sales performances on that day while enjoying the new and modern facilities available in the branch.

The opening rites were also graced by then Vice Governor Daniel Fernando and PSWD Chief Rowena Tiongson.

For more inquiries, call the branch at (044) 7906928 or email wecare@sunlifegrepa.com.

Seen during the opening of Sun Life Grepa’s Bulacan branch were (left to right) Arnold Gutierrez, Sun Life Grepa Region Head; Rowena Tiongson, PSWD Chief of Bulacan; Richard S. Lim, President of Sun Life Grepa; Roy Padiernos, Sun Life Grepa EVP for Agency; and Jo Alegre, Sun Life Grepa VP for Operations.