Important notification on data privacy and cookie notice

We use cookies to ensure you get the best experience on https://www.sunlifegrepa.com. By continuing to browse our site, you are agreeing to our use of cookies.-

PHILIPPINES | EN

- Home

- Insurance

- Back

- Insurance Overview

- Income Continuation

- Education

- Retirement & Estate Preservation

- Preparing for Life’s Milestones

- Health Protection

- Supplementary Benefits

- Group Healthcare

- Loan Protection Program

- Employee Financial Program

- Bancassurance Solutions

- Tools & Services

- Fund Options

- Back

- Fund Options Overview

- NAVPU

- SLG Balanced Fund

- SLG Bond Fund

- SLG Captains Fund

- SLG Dynamic Fund

- SLG Equity Fund

- SLG Global Growth Fund

- SLG Global Income Fund

- SLG Global Opportunity Fund

- SLG Global Opportunity Payout Fund

- SLG Growth Fund

- SLG Growth Plus Fund

- SLG Income Fund

- SLG Index Fund

- SLG MyFuture Fund

- SLG Money Market Fund

- SLG Opportunity Fund

- SLG Opportunity Tracker Fund

- SLG Peso Global Growth Fund

- SLG Peso Global Income Fund

- SLG Peso Global Opportunity Payout Fund

- SLG Peso Global Opportunity Fund

- SLG Peso Global Sustainability Growth Fund

- SLG Peso Global Tech Payout Fund

- SLG Peso Global Tech Growth Fund

- SLG Global Tech Payout Fund

- SLG Global Tech Growth Fund

- Life Goals

- Back

- Life Goals Overview

- Grow Your Money

- Take Care of Your Family

- Nurture Your Health

- Enjoy Retirement

- Money For Life

- About Us

- Back

- About Us Overview

- Who we are

- Our Business Units

- Newsroom

- Corporate Governance

- Corporate Social Responsibility

- Careers

- Find a Form

- FAQs

- Contact Us

- How to file a claim

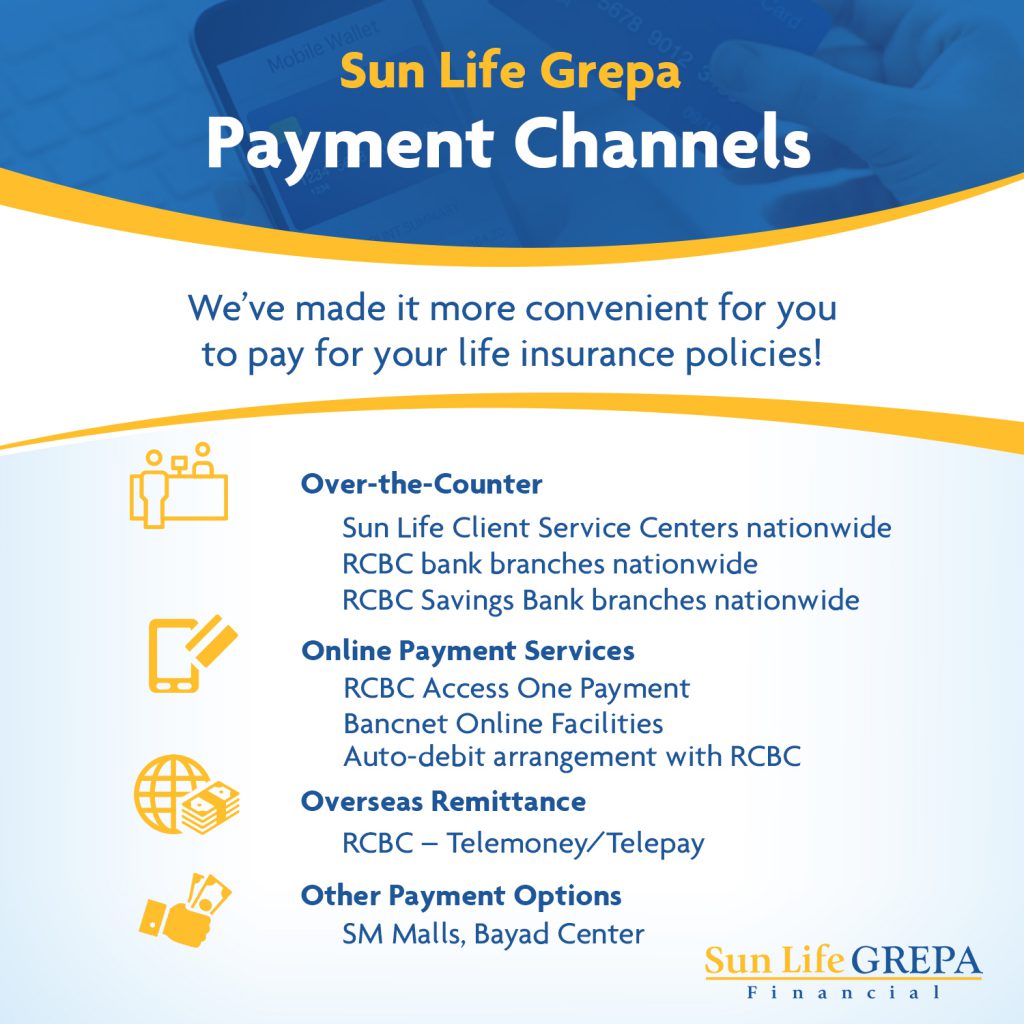

- Payment Channels

- Healthcare Providers

- Sustainability

- Advisor List

Sun Life Grepa clients can now manage their policies anywhere, anytime with the recently launched MySunLifeGrepa Client Portal along with its Sun Life Grepa PH mobile app.

Using the MySunLifeGrepa Client Portal or the Sun Life Grepa PH mobile app, clients can view their policies, update their contact information, or file a claim. For those on the go, the mobile app lets clients enjoy the same convenience through their mobile phones plus the ability to view their VUL fund values, locate the nearest Sun Life Grepa office, or contact a financial advisor.

“With greater digital access, our clients now have the opportunity to keep themselves updated on their life insurance policies through this handy online tool at their convenience,” says Richard S. Lim, President of Sun Life Grepa. “This way, they can make informed decisions about building their financial future with the guidance provided by Sun Life Grepa as their partner beyond a lifetime.”

Sun Life Grepa clients can sign up for the MySunLifeGrepa client portal at https://client.sunlifegrepa.com/portal/login. The Sun Life Grepa PH mobile app can be downloaded from the Google Play Store and Apple App Store.

Sun Life Grepa Financial, Inc. (Sun Life Grepa) is among the top insurance companies in the life insurance industry. For inquiries, contact wecare@sunlifegrepa.com, visit www.sunlifegrepa.com or call (+632) 8499633.

Click on the image to watch the video:

Sun Life Grepa Financial, Inc. (Sun Life Grepa), a major life insurance company in the Philippines, is celebrating its 65th anniversary on a high note as it marks several milestones in line with its mission of providing financial protection solutions to Filipinos.

To begin with, Sun Life Grepa has reached 2.5 million clients, significantly contributing to Sun Life Financial Philippines’ goal of serving 5 million clients by 2020. Meanwhile, the company also increased its total premium income by 21% from its individual and group business, while also growing its agency distribution channel by 33%.

All these resulted from Sun Life Grepa’s efforts to inspire Filipinos to aim for lifetime financial security as well as healthier lives. In fact, this was the rallying theme of the company’s brand campaign dubbed “Build Your Future: Dream It, Live It” which had Judy Ann Santos-Agoncillo as the brand champion.

“Guided by our vision to become the Filipino’s partner beyond a lifetime, our company shall continue to advocate lifetime financial security and healthier lives to Filipinos,” Richard S. Lim, President of Sun Life Grepa, expressed.

On top of its achievements, Sun Life Grepa remains steadfast with its corporate social responsibility efforts through its “Share the Passion” program, where employees are encouraged to volunteer by helping the homeless as well as participating in blood donation drives at the Arnold Jansen KALINGA Center and the children’s ward of the Philippine General Hospital respectively.

“We are happy to share these developments with our stakeholders,” Lim said. “We continue to find ways to help Filipinos achieve financial freedom and we remain driven by our mission to partner with Filipinos in building their dreams throughout and beyond their lifetime.”

As it welcomes another year, Sun Life Grepa aims to carry on its tradition of innovation through its affinity, agency, bancassurance, and group distribution channels.

Sun Life Grepa was established as the Great Pacific Life Assurance Corporation (Grepalife) in 1954 by the late Ambassador Alfonso T. Yuchencgo, an esteemed diplomat, philanthropist, business titan, and the founder of the Yuchengco Group of Companies.

With the intent to provide for the post-World War Two need to protect the financial future of Filipinos, the company pioneered industry innovations such as the installment payment scheme and the salary deduction plan making life insurance affordable for many Filipinos. Moreover, Grepalife also participated in the introduction of the Variable Universal Life (VUL) insurance on top of being the first insurance company to offer credit life insurance.

In 2011, the Yuchengco Group of Companies partnered with Sun Life Financial Philippines in a joint venture, giving birth to Sun Life Grepa Financial, Inc. (Sun Life Grepa).

Sun Life Grepa Financial, Inc. (Sun Life Grepa) continues to grow its presence in the country as it opens its relocated branch in Malolos, Bulacan along MacArthur Highway. This is in keeping with its mission to bring financial awareness to more Filipinos around the country and help protect their goals while living healthier lives.

The event was well-attended by branch personnel, some of whom received recognition for their sales performances on that day while enjoying the new and modern facilities available in the branch.

The opening rites were also graced by then Vice Governor Daniel Fernando and PSWD Chief Rowena Tiongson.

For more inquiries, call the branch at (044) 7906928 or email wecare@sunlifegrepa.com.

Seen during the opening of Sun Life Grepa’s Bulacan branch were (left to right) Arnold Gutierrez, Sun Life Grepa Region Head; Rowena Tiongson, PSWD Chief of Bulacan; Richard S. Lim, President of Sun Life Grepa; Roy Padiernos, Sun Life Grepa EVP for Agency; and Jo Alegre, Sun Life Grepa VP for Operations. Filipinos love celebrating homecomings. This is especially true for those with family members who are Overseas Filipino Workers (OFW). Such homecoming occasions are marked with teary eyes, big smiles, and warm hugs – starting from airport arrival to the various celebrations held to welcome the “balikbayan”.

For an OFW, coming home for Christmas is a holiday highly anticipated in the hearts and minds of his family. Saving up for a round-trip ticket and a family Christmas celebration is no mean feat, given that a big amount of his salary goes to the family’s expenses for their daily needs, education, or even house-building expenses. It is not hard to think then that after the celebrations, the OFW dreads the day going back abroad, beginning another cycle of hard work to provide for the needs of his loved ones and saving up for the next homecoming.

But why not break the cycle and prepare for a future filled with more time with family? Sun Life Grepa Financial, Inc. (Sun life Grepa) offers the chance to build one’s dreams with its various financial protection solutions that include life insurance as well as investment-linked insurance products for different needs in easily affordable installment plans.

“We encourage our kababayans to think of their financial security beyond their employment contract tenure,” says Sun Life Grepa President Richard S. Lim. “While providing for your children’s education or paying for a house is an immediate goal that we want every OFW to achieve, we also want to help our OFWs to be financially prepared for their future regardless of what happens.”

With Sun Life Grepa’s life insurance coverage, an OFW can be assured that his income is protected in case of uncertainty, giving financial security to his family. “An OFW’s salary can only do much to provide for his family’s needs,” says Lim. “By setting aside regular amounts for a life insurance policy, an OFW can provide greater financial benefits to his loved ones beyond his monthly remittances.”

Aside from life coverage, many of Sun Life Grepa’s products come with an investment component that can also help grow the OFW’s savings. “Given that most OFWs save in cash, we want to help them optimize their money’s value over time,” adds Lim.

For an OFW coming home this Christmas, getting financial protection can be the best gift for the family. “We do not want families to be apart for many years,” adds Lim. “The earlier they can financially prepare for their future, the more likely they can actually be permanently re-united with their loved ones sooner and enjoy peace of mind about their future.”

For inquiries, contact (02) 849-9633, email wecare@sunlifegrepa.com , visit any Sun life Grepa branch or www.sunlifegrepa.com Interested OFWs may also visit their nearest RCBC, RCBC Savings Bank or CTBC Bank branch.

Sometimes we encounter unexpected turns in life such as the sudden death of someone we love.

In most cases, this unexpected event leaves one strained by the experience – both emotionally and financially. One can only imagine the family’s struggle to make the necessary preparations for the wake and the burial, and perhaps even for standing medical expenses.

What if people had help in easing their financial burdens during these times, so they can focus on emotional recovery? It would make the matter of rebuilding life much easier.

Extending this kind of support allows companies to help their employees.Companies that genuinely care for their employees must ensure their adequate financial protection so that they can be prepared for such uncertainties and be able to cope better.

These companies can partner with Sun Life Grepa Financial, Inc. (Sun Life Grepa) because, together, both can ensure that the employees and their families are taken care of during the most trying times. With Sun Life Grepa as a steady and reliable partner, companies can provide immediate help and assistance to relieve the emotional and financial burdens of families suddenly experiencing the loss of a loved one.

Sun Life Grepa has the Family Assistance Benefit (FAB) Rider, the latest in its supplementary benefit offerings or “riders” for its Group Life Insurance plan. Through this rider, the bereaved families will receive repatriation and cash assistance to ensure that the deceased safely returns home for burial and that funeral arrangements and/ or interment for the deceased can be made.

The FAB Rider is designed to release the proceeds as soon as possible. With minimal claim requirements and streamlined claiming process, the rider provides support when it is needed most. This way, companies can show sympathy and compassion, while helping ease the financial burden shouldered by the family their employees left behind.

For more information, visit www.sunlifegrepa.com or contact Sun Life Grepa Group Life at (02) 866-6339.

Richard S. Lim, President of Sun Life Grepa Financial, Inc. (Sun Life Grepa) was among the recipients of Mapua University’s “The Outstanding Mapuan” (TOM) award this year.

The annual recognition is given to various alumni of Mapua who have excelled in their respective fields, or have made valuable contributions to the community, the welfare of the school, the country, or the world. It is an annual project, jointly presented by Mapua University and the National Association of Mapua Alumni (NAMA).

Lim’s leadership and industry expertise has been recognized at Sun Life Financial over the years. During his stint from 2006 to 2010 , his team’s work in P.T. Sun Life Indonesia was recognized several times in Sun Life Financial’s CEO’s Excellence Awards.

Upon his return to the Philippines, Lim was appointed Chief Business Operations Development Officer and was primarily responsible for the integration of Sun Life Philippines and Grepalife Financial Inc. back offices and operations. He was appointed Chief Operating Officer of Sun Life Grepa in October 2011 and then Head of Bancassurance in late 2013.

Under his leadership, the team won back-to-back CEO’s Excellence Awards in 2012 and 2013 for the integration project and for Bancassurance business growth.

As the President of one of the leading insurance companies in the Philippines, Lim continues to believe in the power of teamwork. “Teamwork among great individuals brings out more of their talent,” says Lim. “I am grateful to have been surrounded by people whose professional values have helped me become a better servant to Filipinos whose dreams we want to help build.”

Enjoying life at its fullest is one of the many goals that we want to share with our loved ones. With this in mind, more people are now aware about preparing against any unexpected health challenges because even when we are at our best, critical illness could strike when least expected.

“A health crisis affects more than just a person’s body,” says Richard S. Lim, President of Sun Life Grepa Financial, Inc. (Sun Life Grepa). “That person’s family may have to carry the financial burden of ensuring the treatment and recovery of the patient. Without adequate financial protection, medical emergencies can set the family back from their goals and dreams. This is especially true when the person involved is the family’s breadwinner.”

To help address this concern, Sun Life Grepa now offers Sun Grepa Fit and Well, a comprehensive critical illness insurance product that provides guaranteed cash benefits in case of a person’s diagnosis with any of the 114 illnesses covered by the plan. It is a pioneering product in the country that addresses the key stages of a client’s health journey: Prevention, Diagnosis, Treatment and Rehabilitation (PDTR). What’s more, clients availing Sun Grepa Fit & Well also enjoy life insurance coverage until age 100, so their families remain secure no matter what happens.

“At Sun Life Grepa, we believe that preparing for health emergencies is equally important in a person’s journey to achieve financial security,” Lim adds. “We understand how an unforeseen illness can drain a family’s resources that’s why we are offering them the opportunity to help themselves cope during difficult times and enable them to continue pursuing their goals and dreams for a brighter future. Sun Grepa Fit and Well’s focus on the PDTR ideology ensures that the client gets the best, most comprehensive health care possible.”

To ensure that more people can enjoy the benefits of the plan, Sun Grepa Fit and Well can be paid in 10, 15, or 20 annual installments. Semi-quarterly, quarterly, and monthly payment modes are also made available to make the plan more affordable.

Clients can also boost their coverage by availing Sun Grepa Fit and Well Plus or Sun Grepa Fit and Well Advantage. In both variants, clients will receive 5% of their Face Amount for 8 consecutive years as early as age 65. Additional benefits to cover expenses related to hospitalization, follow-up specialist visit, home recovery and palliative care have also been added in the Sun Grepa Fit and Well Advantage variant.

Sun Grepa Fit and Well policyholders automatically become a Gold members when they sign up in the “GoWell” wellness community. GoWell offers relevant health, fitness, and wellness information and free fitness events to Filipinos who wish to live healthier lives.

For more information on Sun Grepa Fit and Well, contact a Sun Life Grepa Advisor at (02) 849-9633 or visit www.sunlifegrepa.com

Visit Sun Grepa Fit and Well Product Page: Sun Grepa Fit and Well

Judy Ann Santos – Agoncillo, a local household name, well-loved actress, and host,partners with Sun Life Grepa Financial Inc. (Sun Life Grepa), one of the top life insurance companies in the country, in its advocacy to help Filipino families secure a brighter, financially protected future.

At a young age, Judy Ann already saw the importance of establishing adequate financial protection and security by acquiring life insurance for herself and loved ones. This move, she recognizes later on, helped her achieve the peace of mind she and her loved ones now enjoy. “I’m now closer to my dream of achieving financial security for both my loved ones and myself, kasi may Sun Life Grepa partner ako. No matter what the future brings, financially protected kami, says Judy Ann.

Achieving financial security is something she hopes others would realize as well. “Marami tayong kababayan who are not financially prepared for the future. It’s important to be ready for life’s milestones and even for unexpected moments. That’s why important sa akin that Sun Life Grepa is able to reach out to as many Filipino families with this message of financial protection.”

Sun Life Grepa is the ideal partner in a person’s financial journey. As one of the top financial protection providers in the country, Sun Life Grepa continually creates innovative life insurance products that are designed to financially assist a person at any stage of their life: starting a career; living your life to the fullest; building your family; or even preparing for your retirement years, Sun Life Grepa has products ready to help their clients achieve financial freedom.

“You don’t have to be born rich to have a financially stable future,” shares Judy Ann. “Whatever you’re capable of right now, that’s all you need and Sun Life Grepa will take it from there and help you secure your future.”

The company boasts of a complete suite of financial solutions as well as fund managers and financial advisors that are ready to assist clients in reaching their dreams and build on the future they want to achieve.

“As early as 18, I believe everyone should already start building their future.” Judy Ann continues, “Dreaming about one’s life aspiration is free, but to actually live it may require financial resources, and the best way to achieve it is with a financial protection partner who can give the right advice and execute these plans according to your needs.” she further added

As of first quarter of 2018, Sun Life Grepa Financial, Inc. (Sun Life Grepa) is helping look after the financial protection needs of over 2 million clients (combined individual and group insurance) as they pursue their aspirations and dreams of living brighter and healthier lives.

This marks another milestone of the company towards its goal of reaching 5 million clients by 2020, a goal it shares with Sun Life Financial Philippines. With the current financial literacy among Filipinos surveyed by Standard & Poor to be at a low 25%, there remains a vast opportunity for the company to grow further in the coming years. “Our mission is all about helping enable as many Filipinos to build and achieve their dreams at any stage of their lives,” says Sun Life Grepa President Richard Lim.

The achievement of touching 2 million lives also highlights a 72% increase in Sun Life Grepa’s premium income in the first quarter of 2018 against the same quarter in 2017.

“As stewards of our client’s financial future, we will continue to strengthen our business capabilities in order for us to provide highly effective products and services to our clients’ evolving financial protection needs,” says Lim. “We thank our clients who have put their trust in us as we work together to help them achieve their aspiration for a financially- secured future.”

For inquiries on Sun Life Grepa, visit www.sunlifegrepa.com or call 8499633.