Understanding the ASA Microinsurance Program

Sun Life Grepa Financial, Inc. (Sun Life Grepa) is a trusted life insurance company in the country with over 70 years of experience in the Philippines.

Sun Life Grepa provides the most ideal insurance coverage for Nanays compared to other life insurance companies.

- Comprehensive coverage

- Affordable annual premium

- Fast claims payout

Aside from providing Nanays financial security in times crisis, the objective of ASA Microinsurance is to help MFOs and ASA Branches with:

- Member Acquisition – Helps MFOs acquire more Nanays.

- Member Retention – Helps MFOs retain more Nanays

- Revenue Generation – Helps MFOs by making Nanays continuously borrow from ASA.

• You’re helping your Nanay Members and their families have peace of mind.

• It adds meaning to your work—you’re not just providing loans, collecting payments, you’re helping families stay secure even in tough times.

• The success of this program will mean more income for ASA.

In times of crisis (loss of Nanay or a family member), the family suffers emotional loss and financial loss. Insurance lessens the financial loss by providing up to 200K in cash benefits to replace income of lost breadwinner until family get back on their feet or to cash benefits can be used to pay final expenses (eg. Burial).

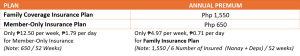

YES. The Member-Only Insurance Plan is Mandatory; with an option to upgrade to the Family Coverage Insurance Plan.

It is now a requirement to be able to get a loan. It has to be mandatory because of impact to price and process.

• Family Coverage Insurance Plan provides the Nanay better value for money as the Plan covers up to a total of 5 people of their family.

• If Nanay settles only for Mandatory Member-Only Insurance Plan and changes her mind after, she can only enroll for Family Coverage Insurance Plan after 1 year, when Member-Only Insurance Plan expires.

What are the ASA Microinsurance Product Offerings?

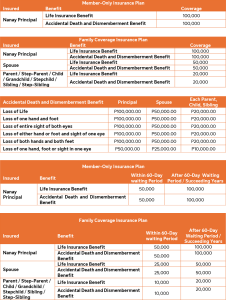

1. Member-only Insurance– Protection for the Nanay only.

2. Family Coverage Insurance – Protection depending on the civil status of the Nanay for:

- Nanay

- Spouse

- Children

- Grandchildren

- Stepchildren

- Parents

- Step-Parents

- Siblings

- Step-Siblings

Member-Only Insurance Plan

• 2nd Cycle and up nanay only

• 18 – 75 years old

• Healthy (not prevented from performing all his normal activities because of injury or illness or is not hospital confined)

Family Coverage Insurance Plan

• Eligible Nanay

• Eligible dependents

- Spouse: 18-75 years old

- Parents (or Step-Parents): 18-75 years old

- Siblings (or Step-Siblings), Children (or Stepchildren), or Grandchildren: 1-24 years old, unmarried and unemployed

Note: All Dependents of Nanay should also be Healthy (not prevented from performing all his normal activities because of injury or illness or is not hospital confined)

Life Insurance Benefit pays a cash benefit in the event of death due to illness, accidents or natural causes.

Accidental Death and Dismemberment Benefit pays a cash benefit on top of Life Insurance Benefit in cases of loss of body part/s or life due to accident. Benefits may be claimed for the following:

• Loss of Life

• Loss of one hand and one foot|

• Loss of entire sight of both eyes

• Loss of either hand or foot and sight of one eye

• Loss of both hands or both feet

• Loss of hand, foot or sight of one eye

No cash out for the Nanay- premium will be automatically deducted from her Capital Build Up (CBU) Savings account.

Nanay will need to make a deposit to her Capital Build-Up (CBU) Account to ensure that they meet the maintaining balance requirement for the CBU account after the deduction of the premium payment.

Yes, there is a signed consent in the enrollment form regarding auto-deduction of premium.

No, even if Nanay withdraws from their ASA Membership the premium isn’t refundable as their insurance coverage will remain active up until after 1 year after their enrollment.

No. Coverage is automatically renewed every year. Annual premium is automatically deducted from the Nanay’s Capital Build Up (CBU) Account. Nanay would just need to fill up the form again if she’s upgrading from Member-Only Insurance Plan to Family Coverage Insurance Plan.

Renewal keeps Nanay and family protected. If Nanay passes away or loses a body part in an accident, insurance gives support and helps her loved ones manage daily needs and adjust during difficult months ahead.

Suicide is an exclusion only during the first policy year. It is no longer excluded in the subsequent renewal years.

Payment of any benefit shall not be made for any claim resulting from;

- Bodily or mental infirmity or disease of any kind, or infection other than infection occurring simultaneously with and in consequence of an accidental cut or wound; or

- Suicide or attempted suicide while sane or insane, or self-inflicted injuries, or

- Committing or trying to commit any crime, felony or other illegal act, or

- Killing by another person under any circumstance/s, murder or provoked assault; or

- Pregnancy, childbirth, miscarriage or any complications thereof, or

- Poison, carbon monoxide or drug overdose, or

- War (declared or undeclared), insurrection, civil commotion or hostile action of armed forces, riots, rebellion; or

- Insect bites, or

- Atomic explosion, nuclear fission, or radioactive gas, or any aviation or marine activities, except while the Member is riding as a fare paying passenger in an air or marine device operated by a commercial airline or shipping line on a scheduled passenger trip over its established passenger route; or

- While engaging in motor-cycling; or

- While engaging in hunting or pillion riding, mountaineering which necessitates the use of ropes or piton, racing of any kind other than on foot; hang gliding, ice or winter sports, water ski-jumping and tricks, yachting beyond five kilometers of a coastline, underwater activities involving the use of underwater apparatus or using woodworking machinery driven by mechanical power other than portable tools applied by hand and used solely for private purposes without reward.

Yes, under Life Insurance Benefit but not under Accidental Death and Dismemberment Benefit.

No, because it is not considered an accident.

No, claims will only apply if there is death or amputation.

Yes, under Life Insurance Benefit but excluded under Accidental Death and Dismemberment Benefit.

Yes, under Life Insurance Benefit but excluded under Accidental Death and Dismemberment Benefit.

Yes, as long as they are considered healthy and able to do normal duties at the time of enrollment.

She can still approach her ASA branch.

Yes, the client is still covered for 1 year. After that, they return to the first cycle and will have to wait to be 2nd cycle for coverage to resume.

Yes, but it must be validated.

Yes, same-sex couples and stepchildren are covered. There is submission of required documents as proof of relationship at the time of claim and provided eligibility criteria are met.

Muslim clients are exempt from availing Mandatory insurance. ASA will introduce Takaful insurance next year.

Enrollment Process

Nanay just needs to fill out the ASA Philippines Group Insurance Enrollment Form during 2nd cycle loan application and submits form to her ASA MFO.

We follow ASA’s standard SOP on handling forms for illiterate clients.

Yes, a client who cannot write or sign can still enroll if she is healthy and meets the rest of the eligibility criteria. The MFO will assist in filling up the form, and the client can affix her thumb mark as signature.

There is no medical requirement but there is a waiting period of 60 days starting from the date of coverage becomes effective.

Please also note that at the time of enrollment, Nanay/Dependent must be heathy (not prevented from performing all his/her normal activities because of injury or illness or is not hospital confined).

Beneficiary assignment depends on the plan:

Yes, they can. Below are the additional claim requirements for stepfamily members, on top of the basic requirements. These may still be subject to further documents upon review:

- Step-parent (stepfather or stepmother)

- Marriage certificate of biological parent of ASA member to new spouse

- Stepchildren

- Marriage Certificate of ASA Member with new spouse

- Birth Certificate of children of new spouse

- Barangay Certificate saying that stepchildren living in same house

- Step-siblings

- Marriage Certificate of biological parent of ASA member to new spouse

- Birth Certificate of children of new spouse

- Barangay Certificate saying that step-siblings living in same house

Yes. As long as there is proof like CENOMAR, plus a barangay certificate showing they live together and/or an affidavit from or neighbor or relative.

Yes, as long as the child is 1-24 years old, healthy (not prevented from performing all his/her normal activities because of injury or illness or is not hospital confined) and has court-appointed guardian.

Yes, as long as there are legal adoption papers. Without papers, the case must be reviewed.

No, if there is an existing legal spouse (“may sabit”), the second spouse cannot be designated as dependent/beneficiary.

Yes, it is allowed as long as we can establish relationship with insured.

Yes, but subject to the conditions set for the family designation.

Individual Insurance Plan

Member-Only Insurance Plan

• All ASA Philippines Members on their 2nd cycle and up

• 18 – 75 years old

• Healthy (not prevented from performing all his normal activities because of injury or illness or is not hospital confined)

Family Coverage Insurance Plan

- All ASA Philippines Members on their 2nd cycle and up

- Age eligibility of Nanay (Principal Member), Spouse or Parents: 18 – 75 years old

- Age eligibility of Children or Siblings: 1 – 21 years old, unmarried and unemployed

Coverage shall start same date as loan approval and disbursement and shall be in effect for one whole year.

MFO will fill out and place a Confirmation of Insurance Coverage to the Nanay’s passbook. A Confirmation of Insurance Coverage Pad will be provided to the branch.

Proof of Cover (POC) will be printed and provided to each Insured Nanay only upon their request.

If Nanay turns 76 years old (termination age), coverage still continues until end of 1-year coverage period.

Claims Process

1.Life/Natural Death Claim

a. Duly signed photocopy or digital copy of SLGFI Claimant’s Statement Form by the beneficiaries

b. Photocopy or digital copy of the Death Certificate from the Local Civil Registrar (LCR) with the registry number (issuance is same day) of the insured (deceased);

Note: in lieu of the Death Certificate, the affidavit of the Nanay Leader and a picture of the wake/standee/guest book/any proof or documents from the funeral parlor/medical certificate attesting the death. Death Certificate should be submitted within 10 calendar days from date of death.

However, it’s still a mandatory requirement to submit a death certificate afterwards even after the claim has been paid.

c. Photocopy or digital copy of Birth Certificate of the Deceased or any substitute identification document:

- The deceased’s government-issued IDs (SSS, GSIS, passport, voter ID, etc.).

- Marriage Contract, Baptismal Certificate

- ASA ID

d. Requirements for the beneficiaries

- If Legal Spouse: Marriage Contract with government-issued IDs (SSS, GSIS, passport, voter ID, etc.).

- If common law spouse: Within Six (6) months Certificate of No Marriage (CENOMAR) from PSA of member and beneficiary/dependent

- If Child/Children/Stepchildren: Birth Certificate or Baptismal Certificate

- If Stepchildren: Marriage Certificate of ASA Member with new spouse and Barangay certificate saying that stepchildren are living in same house.

- If Grandchildren: Birth certificate of parents and Grandchild

- If Parent/Step-Parent: Birth Certificate of ASA Member, Baptismal Certificate, or government ID (SSS, GSIS, passport, voter’s/barangay ID, etc.).

- If Step-Parent: Marriage certificate of biological parent of ASA member to new spouse

- If Siblings/Step-Siblings: Birth Certificate of each sibling/s, Baptismal Certificate, or government ID (SSS, GSIS, passport, voter’s/barangay ID, etc.).

- If Step-Siblings: Marriage Certificate of biological parent of ASA Member with new spouse and Barangay certificate saying that step-siblings are living in same house.

- If Same sex partner: Certificate of No Marriage (CENOMAR) and Barangay Certificate of co-habitation.

e. Photocopy of ASA Group Insurance Enrollment Form

a. SLGFI Claimant’s Statement Form (Disability)

b. SLGFI Attending Physician’s Statement Form (Disability)

c. Complete/Final Police investigation report

d. Operative Record from the hospital

e. Driver’s License (if the insured/member is the driver of a vehicular accident)

The claimant must provide an Affidavit of One and the Same/Certificate of Discrepancy and supporting identification/public document. To prevent this, ensure names match the Birth Certificate at enrollment.

ASA will only release 25% of the total insurance benefit. Remaining 75% will be released until Death Certificate is submitted.

No, the initial released benefit will not be charged as an AR to the branch, but this will be tagged as an Audit Finding to the branch.

Legitimate heirs may claim subject for review.

Yes, claims are processed even on ASA holidays.

Standard filing is within 90 days, but late filing is allowed with letter stating reason for late filing.

Yes, client is covered since coverage starts after the loan is released to the client.

No, once delinquent, the loan balance is not covered.

Similar to our other benefits, MFO has the right to collect back the released amount if the Death Certificate is not submitted.

Dependent coverage is simultaneous with the Nanay coverage. If Nanay dies, insurance plan is terminated.

Yes.

If through representative in the Philippines: They need to submit Consularized Special Power of Attorney (SPA)

If directly submitted by beneficiary/claimant abroad: They need to submit Consularized Claimant’s Statement Form.

Yes, Sun Life Grepa conducts validation checks.

Other Important Questions

ASA Microinsurance remains mandatory, especially the Member-Only Insurance Plan, even if the ASA member already has insurance elsewhere

Yes, both can get their own Family Coverage Insurance Plan separately and they enroll the other as dependent as long as they meet the age requirements and daughter is either single or single parent.

Yes, as long as they qualify as dependents and meet the age and status required:

- Nanay, Spouse or Parents, Step-Parents: 18 to 75 years old

- Siblings, Step-Siblings or Children, Step-children, Grandchildren: 1 to 24 years old, unmarried and unemployed

We’re currently working for our Nanays who have recently renewed their loans to be able to avail of the Microinsurance.

What they can do in the meantime is do an early payment of their existing loan & avail of a new loan to be able to avail of the Microinsurance.

Yes. If Nanay is insured, there is no more FBA, except for 1st cycle clients.

ASA Microinsurance is still mandatory, but a client cannot have two ASA Microinsurance policies.

Yes, hospitalization benefits remain. Only FBA will be removed (official announcement to follow).

Health insurance will be introduced next year.

Not yet. Clients must first have a microbusiness loan.

Only for the pilot phase. For full rollout, incentives will be evaluated.

The claim wills till follow what is tagged in EMFOR.

We will follow what’s placed in the Enrollment form. This may be tagged as an audit issue with the MFO.

If Principal/Dependent is healthy at the time of enrollment and later becomes bedridden/unhealthy, coverage still continues. That is why it’s important to get insurance while you are still healthy/insurable.

If they turn 76 years old (termination age), coverage continues until end of 1-year coverage period.

If they turn 25 years old (termination age) or get married, whichever comes first, coverage continues until end of 1-year coverage period.